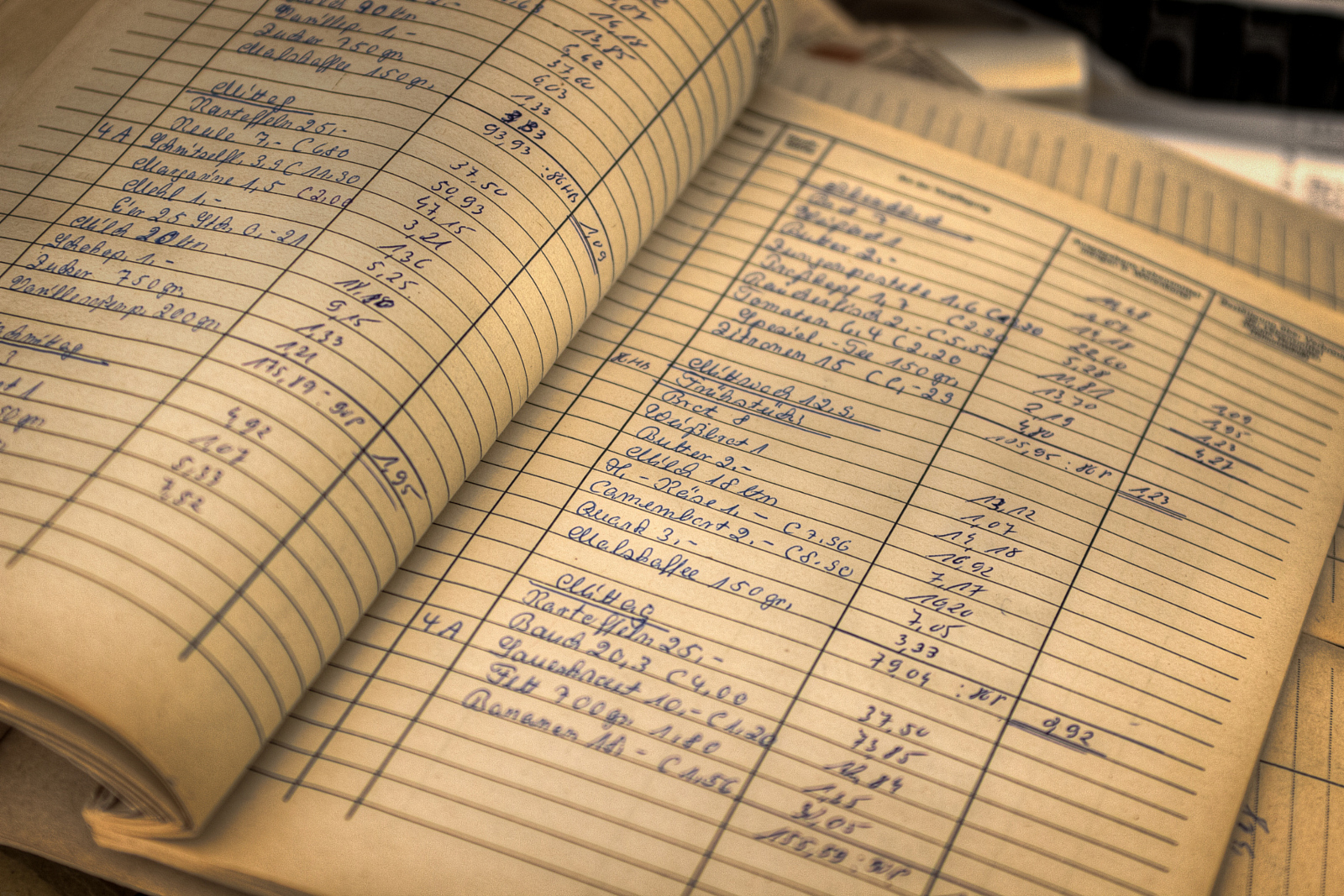

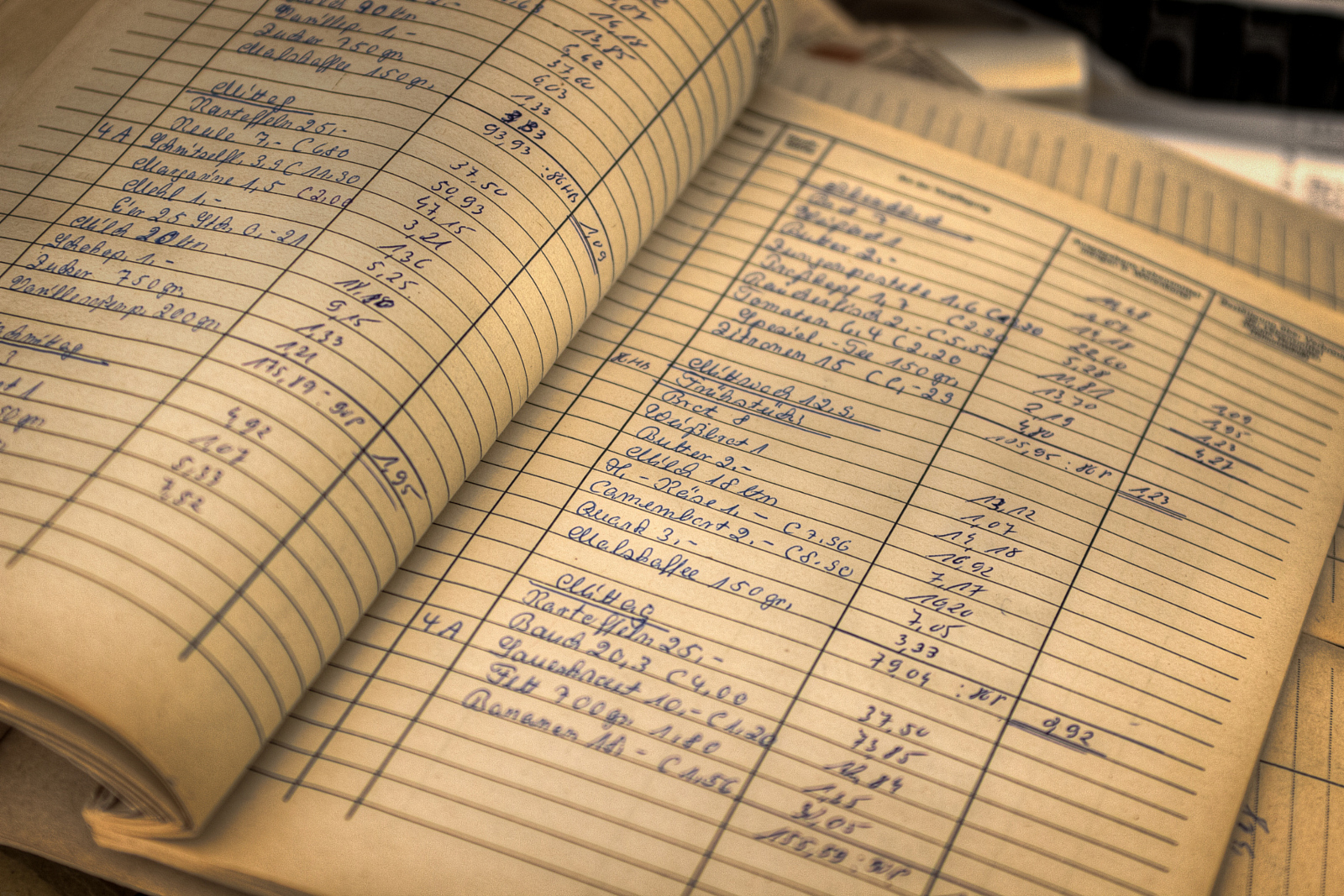

BOOK-KEEPING & MIS

If you do not have the internal resources to carry on day to day book keeping functions or prefer to outsource such functions so that you can just focus on your business, we will prepare and maintain the business accounting records. Our book keeping service is cost effective and efficient. You just provide records of sales, purchases, bank statements, cheques stubs etc. and our book-keeping services entails posting of your transactions using suitable accounting software. We will do the writing up of your books and records. Providing you information about companies position on:

- A record of sales

- A record of purchases

- A record of amounts owed to the business

- A record of amounts owed by the business

- Records of bank receipts and payments

- Records of cash receipts and payments

- Reconciliation of bank accounts

- Inventory levels

- Fixed assets register